From 1.1.2024 there will be new VAT rates:

7.7% becomes 8.1%.

2.5% becomes 2.6%

3.7% becomes 3.8%.

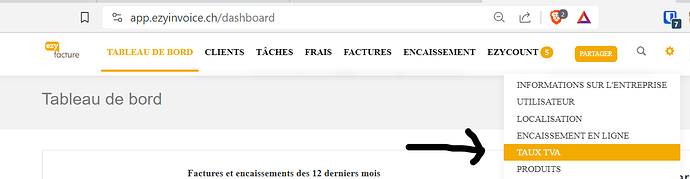

Go to the VAT menu:

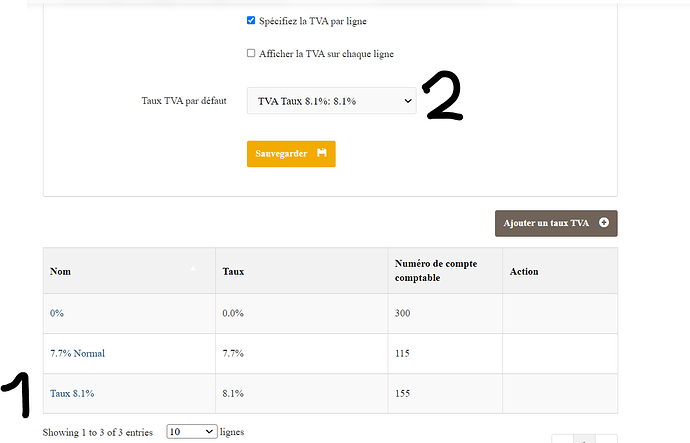

- Add a new VAT rate - 8.1% with the accounting number 155 - if you have linked EZYcount to EZYinvoice, check this number, otherwise use 155.

- Change the default rate with the new rate you have created.

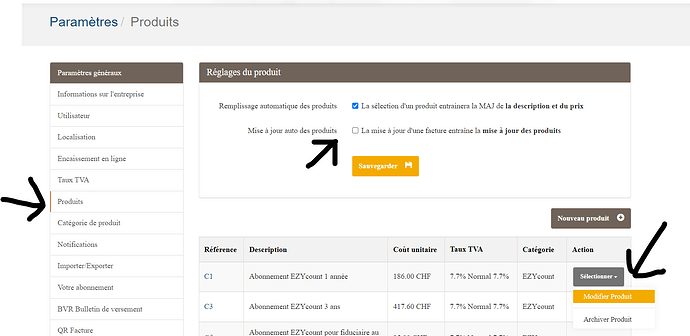

Next, you need to change the basic VAT rates for your products by accessing the product menu. You have two options:

- you change each product by selecting it and changing the tax rate or

- You activate that the products are also updated when you update invoices. So when you write invoices, check whether the tax rate is correct. If this is not the case, change it. Once you have saved the invoice, the product is updated.